About this report

The State Tourism Satellite Account (STSA) data tables are useful in understanding:

- the value of tourism goods and services consumed by visitors in a state or territory.

- tourism’s contribution to Gross State Product (GSP), exports and jobs.

Tourism Research Australia (TRA) compiled the 2021-22 STSA. The most recent year is compared with earlier years and a time series of results (2006-07 to 2021-22) is presented in the data tables at the end of this summary.

TRA used its internal data (Regional Expenditure) as sources for the STSA along with:

- the Australian Bureau of Statistics’ (ABS)

- Australian Tourism Satellite Account (TSA) data

- Labour Accounts Australia data

- State Accounts data.

The STSA complements the work of the TSA. This is done by examining state and territory tourism performance and estimating the indirect economic and jobs impacts of tourism. The detailed statistical tables that accompany this report also include tourism Gross Value Added (GVA), tourism output and data for different tourism industries.

Read about the terminology we use and how we apply the data in the explanatory notes further below.

The visitor economy recovery from COVID-19

Tourism is based on person-to-person interactions and the freedom to travel. Australia’s visitor economy continued to be disproportionately affected through the first half of 2021-22. This was caused by international and state border closures and geographically specific lockdowns. By the start of 2022, however, recovery was underway, supported by:

- the reopening of Australian borders to international visitors and state and territory borders to interstate travel

- the lifting of widespread lockdowns, travel restrictions and patronage limits on tourism businesses and venues

- increases to domestic flights and room availability at hotels, motels, and serviced apartments

- improved travel confidence due to easing health and safety concerns

- strong pent-up demand for travel.

These developments saw a quick turnaround in domestic travel from the start of 2022. The recovery for international travel built more slowly from a very low base.

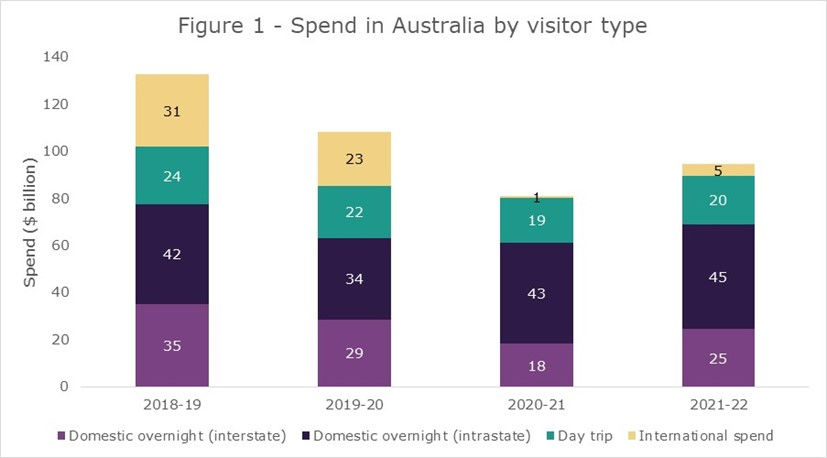

Total tourism demand in the form of visitor spend in Australia in 2021-22 was $94.4 billion (Figure 1 below). This was up 17% or $13.5 billion on 2020-21 but down 29% or $38.2 billion on 2018-19 (pre-pandemic):

- international visitor spend in 2021-22 was nearly 7 times higher than in 2020-21 but still 84% less than 2018-19

- domestic overnight visitor spend increased 13% on 2020-21 but was still down 11% on the pre-pandemic level

- domestic day trip visitor spend was up 8% on 2020-21 but still 16% below the pre-pandemic level.

Tourism consumption

Tourism consumption was $96.8 billion in 2021-22. With domestic travel recovering strongly in the first half of 2022 and international arrivals steadily building, this was up 20% (or $16.4 billion) on the previous year. However, consumption was down 36% ($55.5 billion) from the pre-pandemic high in 2018-19.

Table 1 below shows that tourism consumption improved for all states and territories except New South Wales in 2021-22 when compared with the previous year. Having been hit particularly hard by the pandemic in 2020-21, Victoria had the strongest growth (53% or $7.1 billion).

Among the other states with increases, this varied as follows:

- Northern Territory up 30.4% ($0.5 billion)

- Queensland up 30% ($6.2 billion)

- Western Australia up 22.8% ($2.1 billion)

- Tasmania up 18.7% ($0.5 billion)

- Australian Capital Territory 13.8% ($0.2 billion).

When compared to pre-pandemic levels, visitor consumption in 2021-22 still fell short by 36% overall.

| State | Consumption 2021-22 | Change from 2020-21 | Change from 2018-19 | ||

| $ billion | $ billion | Per cent | $ billion | Per cent | |

| New South Wales | 25.1 | -0.3 | -1% | -21.5 | -46% |

| Victoria | 20.4 | 7.1 | 53% | -15.8 | -44% |

| Queensland | 26.7 | 6.2 | 30% | -7.9 | -23% |

| South Australia | 6.2 | 0.1 | 1% | -2.8 | -32% |

| Western Australia | 11.2 | 2.1 | 23% | -3.9 | -26% |

| Tasmania | 3.3 | 0.5 | 19% | -1.2 | -26% |

| Northern Territory | 2.1 | 0.5 | 30% | -1.0 | -32% |

| Australian Capital Territory | 1.7 | 0.2 | 14% | -1.4 | -45% |

| Total | 96.8 | 16.4 | 20% | -55.5 | -36% |

Gross State Product from tourism

Direct tourism GSP for all states and territories was $36.5 billion in 2021-22. This was up 31% on 2020-21 and down 39% on 2018-19. By comparison, Gross Domestic Product (GDP) for the Australian economy in 2021-22 grew 11% on 2020-21 and 19% on 2018-19.

As a result, tourism’s direct share of the national economy fell from 3.1% in 2018-19 to 1.3% by 2020-21 before increasing to 1.6% in 2021-22.

Table 2 below shows there were increases in direct tourism GSP for all states and territories in 2021-22 compared with 2020-21 levels. This growth varied across different jurisdictions:

- Victoria – up 62% (or $2.9 billion)

- Queensland – up 46% (or $3.3 billion)

- Northern Territory – up 45% (0.2 billion)

- Western Australia – up 34% (or $1.0 billion)

- Australian Capital Territory – up 28% (or $0.1 billion)

- Tasmania – up 25% (or $0.2 billion).

- New South Wales – up 8% (or $0.7 billion)

- South Australia – up 7% (or $0.2 billion).

Despite the improvements in direct tourism GSP over the last year, all states’ and territories’ GSP were lower in 2021-22 than in pre-pandemic 2018-19.

| State | GSP 2021-22 | Change from 2020-21 | Change from 2018-19 | ||

| $ billion | $ billion | Per cent | $ billion | Per cent | |

| New South Wales | 9.6 | 0.7 | 8% | -8.8 | -48% |

| Victoria | 7.6 | 2.9 | 62% | -7.0 | -48% |

| Queensland | 10.3 | 3.3 | 46% | -3.4 | -25% |

| South Australia | 2.3 | 0.2 | 7% | -1.3 | -35% |

| Western Australia | 4.1 | 1.0 | 34% | -1.9 | -32% |

| Tasmania | 1.2 | 0.2 | 25% | -0.5 | -30% |

| Northern Territory | 0.8 | 0.2 | 45% | -0.3 | -31% |

| Australian Capital Territory | 0.7 | 0.1 | 28% | -0.6 | -46% |

| Total | 36.5 | 8.7 | 31% | -23.8 | -39% |

Indirect tourism GSP for all states and territories was $40.5 billion in 2021-22. As a result, total GSP (direct plus indirect) was $77.0 billion in 2021-22. This indirect GSP contribution represented a 1.8% share of national GDP in 2021-22. This compares with a 1.6% share in 2020-21 and a 3.3% share in 2018-19.

In measuring the total GSP impacts, Table 3 presents similar findings to Table 2 (Direct tourism GSP). Table 3 below shows that the:

- The change on 2020-21 varied between -2% for New South Wales and 54% for Victoria

- The deficit on 2018-19 remained between 23% for Queensland and 47% for New South Wales.

| State | GSP 2021-22 | Change from 2020-21 | Change from 2018-19 | ||

| $ billion | $ billion | Per cent | $ billion | Per cent | |

| New South Wales | 10.5 | -0.2 | -2% | -9.2 | -47% |

| Victoria | 8.4 | 3.0 | 54% | -6.4 | -43% |

| Queensland | 11.2 | 2.5 | 30% | -3.3 | -23% |

| South Australia | 2.8 | 0.0 | 2% | -1.5 | -35% |

| Western Australia | 4.6 | 0.9 | 24% | -1.5 | -25% |

| Tasmania | 1.4 | 0.2 | 18% | -0.5 | -26% |

| Northern Territory | 0.9 | 0.2 | 28% | -0.5 | -35% |

| Australian Capital Territory | 0.7 | 0.1 | 14% | -0.5 | -43% |

| Total | 40.5 | 6.8 | 20% | -23.5 | -37% |

Tourism filled jobs

Last year ABS adopted ‘tourism filled jobs’ as the standard metric for reporting tourism employment. The 2021-22 STSA therefore uses this metric for the first time (see explanatory notes for further information).

In 2021-22 there were 501,500 direct tourism filled jobs, which was up 22% on the previous year. This compares with 3.4% growth in Australian jobs over the same period. As a result, tourism’s share of total filled jobs increased from 2.9% in 2020-21 to 3.4% in 2021-22. However, in 2018-19, before the COVID-19 pandemic, tourism provided 700,900 jobs, which was 5.0% of total jobs in Australia.

In addition to direct jobs, tourism generated a further 251,000 jobs indirectly in the economy making a total contribution of 753,000 direct and indirect jobs to the visitor economy. As a share of economy, tourism’s indirect jobs contribution increased from 1.5% in 2020-21 to 1.7% in 2021-22. This share was 2.9% in 2018-19.

All states and territories except New South Wales and South Australia had growth in direct tourism filled jobs in 2021-22. For total tourism filled jobs (direct plus indirect) the same applied. All states and territories except New South Wales and South Australia experienced growth in tourism jobs. New South Wales and South Australia were only marginally lower over the year (Table 4 below).

Compared with 2018-19 levels, the recovery in tourism filled jobs across jurisdictions was at different stages in 2021-22. The deficits in direct tourism filled jobs were:

- less than 25%: Queensland (11%), Western Australia (14%), Tasmania (16%), the Northern Territory (18%) and South Australia (21%)

- more than 35%: New South Wales (42%), the Australian Capital Territory (37 and Victoria (36%).

| State | Tourism Jobs 2021-22 (000) | Change from 2020-21 (%) | Change from 2018-19 (%) | |||

| Direct jobs | Total jobs* | Direct jobs | Total jobs* | Direct jobs | Total jobs* | |

| New South Wales | 116.6 | 174.5 | -3% | -2% | -42% | -45% |

| Victoria | 121.9 | 171.1 | 56% | 56% | -36% | -40% |

| Queensland | 134.4 | 206.2 | 33% | 32% | -11% | -17% |

| South Australia | 34.0 | 50.7 | -2% | -1% | -21% | -26% |

| Western Australia | 61.5 | 89.1 | 23% | 23% | -14% | -19% |

| Tasmania | 19.3 | 37.3 | 16% | 17% | -16% | -20% |

| Northern Territory | 6.9 | 12.5 | 28% | 28% | -18% | -25% |

| Australian Capital Territory | 6.9 | 11.6 | 10% | 10% | -37% | -41% |

| Total | 501.5 | 753.0 | 22% | 22% | -28% | -32% |

*Denotes direct and indirect tourism jobs

Australian Capital Territory summary

Total tourism GSP

$1.4 billion

Up 20% compared with 2020–21

Down 45% compared with 2018–19

Total tourism GVA

$1.2 billion

Up 21% compared with 2020–21

Down 45% compared with 2018–19

Total tourism filled jobs

11,600

Up 10% compared with 2020–21

Down 41% compared with 2018–19

Tourism GSP

In 2021–22:

- direct tourism GSP in the ACT was worth $0.659 billion (up 28% on 2020-21 and down 46% on 2018-19)

- this was a 1.4% direct share of total territory GSP (up 0.3% on 2020-21 and down 1.6% on 2018-19)

- total territory GSP was worth $46.4 billion (up 4.3% on 2020-21 and up 15% on 2018-19)

- indirect tourism GSP was worth an extra $0.728 billion to the ACT economy (up 14% on 2020-21 and down 43% on 2018-19)

- total tourism GSP (both direct and indirect) was worth $1.4 billion to the ACT economy (up 20% on 2020-21 and down 45% on 2018-19).

Tourism GVA

In 2021–22:

- direct tourism GVA in the ACT was worth $0.605 billion (up 27% on 2020-21 and down 46% on 2018-19)

- this was a 1.4% direct share of total territory GVA (up 0.2% on 2020-21 and down 1.6% on 2018-19)

- total territory GVA was worth $44.2 billion (up 4.6% on 2020-21 and up 16% on 2018-19)

- indirect tourism GVA was worth an extra $0.611 billion to the ACT economy (up 16% on 2020-21 and down 44% on 2018-19)

- total tourism GVA (both direct and indirect) was worth $1.2 billion to the ACT economy (up 21% on 2020-21 and down 45% on 2018-19).

Tourism filled jobs

In 2021–22:

- direct tourism filled jobs in the ACT totalled 6,900 (up 10% on 2020-21 and down 37% on 2018-19)

- this was a 2.8% direct share of total territory filled jobs (up 0.2% on 2020-21 and down 1.7% on 2018-19)

- total territory filled jobs amounted to 250,000 (up 0.4% on 2020-21 and up 0.8% on 2018-19)

- indirectly tourism added a further 4,700 jobs in the ACT (up 15% on 2020-21 and down 45% on 2018-19)

- total tourism filled jobs (both direct and indirect) totalled 11,600 in the ACT (up 10% on 2020-21 and down 41% on 2018-19).

Notes

What is direct contribution?

Direct contribution refers to money spent directly in the tourism industry. Without a tourism industry in the ACT, this money wouldn’t be generated, or these people wouldn’t be employed.

What is indirect contribution?

The flow-on effect of the tourism industry. In the ACT, for every dollar spent in the tourism industry, an additional 84 cents of related expenditure was generated and spent elsewhere in the economy.

Why we use GVA

GVA allows easier comparisons across industries. GVA is equal to GSP minus taxes.

New South Wales summary

Total tourism GSP

$20.1 billion

Up 2.8% compared with 2020–21

Down 47% compared with 2018–19

Total tourism GVA

$17.6 billion

Up 3.1% compared with 2020–21

Down 48% compared with 2018–19

Total tourism filled jobs

174,500

Down 2.4% compared with 2020–21

Down 45% compared with 2018–19

Tourism GSP

In 2021–22:

- direct tourism GSP in New South Wales was worth $9.6 billion (up 8.2% on 2020-21 and down 48% on 2018-19)

- this was a 1.4% direct share of total state GSP (unchanged on 2020-21 and down 1.6% on 2018-19)

- total state GSP was worth $697.4 billion (up 7.4% on 2020-21 and up 11% on 2018-19)

- indirect tourism GSP was worth an extra $10.5 billion to the New South Wales economy (down 1.6% on 2020-21 and down 47% on 2018-19)

- total tourism GSP (both direct and indirect) was worth $20.1 billion to the New South Wales economy (up 2.8% on 2020-21 and down 47% on 2018-19).

Tourism GVA

In 2021–22:

- direct tourism GVA in New South Wales was worth $8.8 billion (up 7.1% on 2020-21 and down 48% on 2018-19)

- this was a 1.4% direct share of total state GVA (unchanged from 2020-21 and down 1.5% on 2018-19)

- total state GVA was worth $641.5 billion (up 7.2% on 2020-21 and up 11% on 2018-19)

- indirect tourism GVA was worth an extra $8.8 billion to the New South Wales economy (down 0.6% on 2020-21 and down 48% on 2018-19)

- total tourism GVA (both direct and indirect) was worth $17.6 billion to the New South Wales economy (up 3.1% on 2020-21 and down 48% on 2018-19).

Tourism filled jobs

In 2021–22:

- direct tourism filled jobs in New South Wales totalled 116,600 (down 2.9% on 2020-21 and down 42% on 2018-19)

- this was a 2.6% direct share of total state’s filled jobs (down 0.1% on 2020-21 and down 2.0% on 2018-19)

- total state filled jobs amounted to 4.5 million (up 1.0% on 2020-21 and up 1.7% on 2018-19)

- indirectly tourism added a further 57,700 jobs in New South Wales (down 1.7% on 2020-21 and down 50% on 2018-19)

- total tourism filled jobs (both direct and indirect) totalled 174,500 in New South Wales (down 2.4% on 2020-21 and down 45% on 2018-19).

Notes

What is direct contribution?

Direct contribution refers to money spent directly in the tourism industry. Without a tourism industry in New South Wales, this money wouldn’t be generated, or these people wouldn’t be employed.

What is indirect contribution?

The flow-on effect of the tourism industry. In New South Wales, for every dollar spent in the tourism industry, an additional 82 cents of related expenditure was generated and spent elsewhere in the economy.

Why we use GVA

GVA allows easier comparisons across industries. GVA is equal to GSP minus taxes.

Northern Territory summary

Total tourism GSP

$1.7 billion

Up 35% compared with 2020–21

Down 33% compared with 2018–19

Total tourism GVA

$1.5 billion

Up 35% compared with 2020–21

Down 32% compared with 2018–19

Total tourism filled jobs

12,500

Up 28% compared with 2020–21

Down 25% compared with 2018–19

Tourism GSP

In 2021–22:

- direct tourism GSP in the NT was worth $0.784 billion (up 45% on 2020-21 and down 31% on 2018-19)

- this was a 2.5% direct share of total territory GSP (up 0.3% on 2020-21 and down 2.0% on 2018-19)

- total territory GSP was worth $31.1 billion (up 25% on 2020-21 and up 24% on 2018-19)

- indirect tourism GSP was worth an extra $0.949 billion to the NT economy (up 28% on 2020-21 and down 35% on 2018-19)

- total tourism GSP (both direct and indirect) was worth $1.7 billion to the NT economy (up 35% on 2020-21 and down 33% on 2018-19).

Tourism GVA

In 2021–22:

- direct tourism GVA in the NT was worth $0.709 billion (up 42% on 2020-21 and down 31% on 2018-19)

- this was a 2.4% direct share of total territory GVA (up 0.3% on 2020-21 and down 1.9% on 2018-19)

- total territory GVA was worth $29.6 billion (up 24% each on 2020-21 and 2018-19)

- indirect tourism GVA was worth an extra $0.758 billion to the NT economy (up 29% on 2020-21 and down 32% on 2018-19)

- total tourism GVA (both direct and indirect) was worth $1.5 billion to the NT economy (up 35% on 2020-21 and down 32% on 2018-19).

Tourism filled jobs

In 2021–22:

- direct tourism filled jobs in the NT totalled 6,900 (up 28% on 2020-21 and down 18% on 2018-19)

- this was a 4.7% direct share of total territory filled jobs (up 1.0% on 2020-21 and down 1.5% on 2018-19)

- total territory filled jobs amounted to 147,000 (up 4.8% on 2020-21 and up 7.5% on 2018-19)

- indirectly tourism added a further 5,600 jobs in the NT (up 27% on 2020-21 and down 33% on 2018-19)

- total tourism filled jobs (both direct and indirect) totalled 12,500 in the NT (up 28% on 2020-21 and down 25% on 2018-19).

Notes

What is direct contribution?

Direct contribution refers to money spent directly in the tourism industry. Without a tourism industry in the NT, this money wouldn’t be generated, or these people wouldn’t be employed.

What is indirect contribution?

The flow-on effect of the tourism industry. In the NT, for every dollar spent in the tourism industry, an additional 85 cents of related additional expenditure was generated and spent elsewhere in the economy.

Why we use GVA

GVA allows easier comparisons across industries. GVA is equal to GSP minus taxes.

Queensland summary

Total tourism GSP

$21.5 billion

Up 37% compared with 2020–21

Down 24% compared with 2018–19

Total tourism GVA

$19.0 billion

Up 37% compared with 2020–21

Down 24% compared with 2018–19

Total tourism filled jobs

206,200

Up 32% compared with 2020–21

Down 17% compared with 2018–19

Total tourism filled jobs

206,200

Up 32% compared with 2020–21

Down 17% compared with 2018–19

Tourism GSP

In 2021–22:

- direct tourism GSP in Queensland was worth $10.3 billion (up 46% on 2020-21 and down 25% on 2018-19)

- this was a 2.3% direct share of total state GSP (up 0.4% on 2020-21 and down 1.4% on 2018-19)

- total state GSP was worth $447.5 billion (up 22% each on 2020-21 and on 2018-19)

- indirect tourism GSP was worth an extra $11.2 billion to the Queensland economy (up 30% on 2020-21 and down 23% on 2018-19)

- total tourism GSP (both direct and indirect) was worth $21.5 billion to the Queensland economy (up 37% on 2020-21 and down 24% on 2018-19).

Tourism GVA

In 2021–22:

- direct tourism GVA in Queensland was worth $9.4 billion (up 44% on 2020-21 and down 25% on 2018-19)

- this was a 2.3% direct share of total state GVA (up 0.4% on 2020-21 and down 1.4% on 2018-19)

- total state GVA was worth $418.3 billion (up 22% on 2020-21 and up 21% on 2018-19)

- indirect tourism GVA was worth an extra $9.5 billion to the Queensland economy (up 31% on 2020-21 and down 24% on 2018-19)

- total tourism GVA (both direct and indirect) was worth $19.0 billion to the Queensland economy (up 37% on 2020-21 and down 24% on 2018-19).

Tourism filled jobs

In 2021–22:

- direct tourism filled jobs in Queensland totalled 134,400 (up 33% on 2020-21 and down 11% on 2018-19)

- this was a 4.4% direct share of total state’s filled jobs (up 0.9% on 2020-21 and down 0.9% on 2018-19)

- total state filled jobs amounted to 3.1 million (up 5.0% on 2020-21 and up 7.2% on 2018-19)

- indirectly tourism added a further 71,700 jobs in Queensland (up 31% on 2020-21 and down 26% on 2018-19)

- total tourism filled jobs (both direct and indirect) totalled 206,200 in Queensland (up 32% on 2020-21 and down 17% on 2018-19).

Notes

What is direct contribution?

Direct contribution refers to money spent directly in the tourism industry. Without a tourism industry in Queensland, this money wouldn’t be generated, or these people wouldn’t be employed.

What is indirect contribution?

The flow-on effect of the tourism industry. In Queensland, for every dollar spent in the tourism industry, an additional 85 cents of related expenditure was generated and spent elsewhere in the economy.

Why we use GVA

GVA allows easier comparisons across industries. GVA is equal to GSP minus taxes.

South Australia summary

Total tourism GSP

$5.1 billion

Up 4.1% compared with 2020–21

Down 35% compared with 2018–19

Total tourism GVA

$4.3 billion

Up 3.5% compared with 2020–21

Down 35% compared with 2018–19

Total tourism filled jobs

50,700

Down 0.8% compared with 2020–21

Down 26% compared with 2018–19

Tourism GSP

In 2021–22:

- direct tourism GSP in South Australia was worth $2.3 billion (up 7.3% on 2020-21 and down 35% on 2018-19)

- this was a 1.8% direct share of total state GSP (unchanged from 2020-21 and down 1.4% on 2018-19)

- total state GSP was worth $128.6 billion (up 8.7% on 2020-21 and up 17% on 2018-19)

- indirect tourism GSP was worth an extra $2.8 billion to the South Australian economy (up 1.6% on 2020-21 and down 35% on 2018-19)

- total tourism GSP (both direct and indirect) was worth $5.1 billion to the South Australian economy (up 4.1% on 2020-21 and down 35% on 2018-19).

Tourism GVA

In 2021–22:

- direct tourism GVA in South Australia was worth $2.1 billion (up 6.0% on 2020-21 and down 36% on 2018-19)

- this was a 1.7% direct share of total state GVA (down 0.1% on 2020-21 and down 1.5% on 2018-19)

- total state GVA was worth $120.5 billion (up 10% on 2020-21 and up 18% on 2018-19)

- indirect tourism GVA was worth an extra $2.2 billion to the South Australian economy (up 1.3% on 2020-21 and down 33% on 2018-19)

- total tourism GVA (both direct and indirect) was worth $4.3 billion to the South Australian economy (up 3.5% on 2020-21 and down 35% on 2018-19).

Tourism filled jobs

In 2021–22:

- direct tourism filled jobs in South Australia totalled 34,000 (down 1.7% on 2020-21 and down 21% on 2018-19)

- this was a 3.4% direct share of total state’s filled jobs (down 0.2% on 2020-21 and down 1.2% on 2018-19)

- total state filled jobs amounted to 991,000 (up 4.6% on 2020-21 and up 6.7% on 2018-19)

- indirectly tourism added a further 16,700 jobs in South Australia (up 1.8% on 2020-21 and down 35% on 2018-19)

- total tourism filled jobs (both direct and indirect) totalled 50,700 in South Australia (down 0.8% on 2020-21 and down 26% on 2018-19).

Notes

What is direct contribution?

Direct contribution refers to money spent directly in the tourism industry. Without a tourism industry in South Australia, this money wouldn’t be generated, or these people wouldn’t be employed.

What is indirect contribution?

The flow-on effect of the tourism industry. In South Australia, for every dollar spent in the tourism industry, an additional 81 cents of related additional expenditure was generated and spent elsewhere in the economy.

Why we use GVA

GVA allows easier comparisons across industries. GVA is equal to GSP minus taxes.

Tasmania summary

Total tourism GSP

$2.6 billion

Up 21% compared with 2020–21

Down 28% compared with 2018–19

Total tourism GVA

$2.3 billion

Up 20% compared with 2020–21

Down 28% compared with 2018–19

Total tourism filled jobs

37,300

Up 17% compared with 2020–21

Down 20% compared with 2018–19

Tourism GSP

In 2021–22:

- direct tourism GSP in Tasmania was worth $1.2 billion (up 25% on 2020-21 and down 30% on 2018-19)

- this was a 3.2% direct share of total state GSP (up 0.4% on 2020-21 and down 2.3% on 2018-19)

- total state GSP was worth $38.5 billion (up 9.3% on 2020-21 and up 20% on 2018-19)

- indirect tourism GSP was worth an extra $1.4 billion to the Tasmanian economy (up 18% on 2020-21 and down 26% on 2018-19)

- total tourism GSP (both direct and indirect) was worth $2.6 billion to the Tasmanian economy (up 21% on 2020-21 and down 28% on 2018-19)

Tourism GVA

In 2021–22:

- direct tourism GVA in Tasmania was worth $1.1 billion (up 23% on 2020-21 and down 30% on 2018-19)

- this was a 3.0% direct share of total state GVA (up 0.3% on 2020-21 and down 2.2% on 2018-19)

- total state GVA was worth $36.2 billion (up 10% on 2020-21 and up 21% on 2018-19)

- indirect tourism GVA was worth an extra $1.2 billion to the Tasmanian economy (up 18% on 2020-21 and down 27% on 2018-19)

- total tourism GVA (both direct and indirect) was worth $2.3 billion to the Tasmanian economy (up 20% on 2020-21 and down 28% on 2018-19).

Tourism filled jobs

In 2021–22:

- direct tourism filled jobs in Tasmania totalled 19,300 (up 16% on 2020-21 and down 16% on 2018-19)

- this was a 6.3% direct share of total state’s filled jobs (up 0.6% on 2020-21 and down 1.4% on 2018-19)

- total state filled jobs amounted to 307,000 (up 5.0% on 2020-21 and up 3.5% on 2018-19)

- indirectly tourism added a further 17,900 jobs in Tasmania (up 17% on 2020-21 and down 26% on 2018-19)

- total tourism filled jobs (both direct and indirect) totalled 37,300 in Tasmania (up 17% on 2020-21 and down 20% on 2018-19).

Notes

What is direct contribution?

Direct contribution refers to money spent directly in the tourism industry. Without a tourism industry in Tasmania, this money wouldn’t be generated, or these people wouldn’t be employed.

What is indirect contribution?

The flow-on effect of the tourism industry. In Tasmania, for every dollar spent in the tourism industry, an additional 86 cents of additional expenditure was generated and spent elsewhere in the economy.

Why we use GVA

GVA allows easier comparisons across industries. GVA is equal to GSP minus taxes.

Victoria summary

Total tourism GSP

$16.0 billion

Up 58% compared with 2020–21

Down 46% compared with 2018–19

Total tourism GVA

$14.1 billion

Up 58% compared with 2020–21

Down 47% compared with 2018–19

Total tourism filled jobs

171,100

Up 56% compared with 2020–21

Down 40% compared with 2018–19

Tourism GSP

In 2021–22:

- direct tourism GSP in Victoria was worth $7.6 billion (up 62% on 2020-21 and down 48% on 2018-19)

- this was a 1.5% direct share of total state GSP (up 0.5% on 2020-21 and down 1.7% on 2018-19)

- total state GSP was worth $515.2 billion (up 8.6% on 2020-21 and up 12% on 2018-19)

- indirect tourism GSP was worth an extra $8.4 billion to the Victorian economy (up 54% on 2020-21 and down 43% on 2018-19)

- total tourism GSP (both direct and indirect) was worth $16.0 billion to the Victorian economy (up 58% on 2020-21 and down 46% on 2018-19).

Tourism GVA

In 2021–22:

- direct tourism GVA in Victoria was worth $6.9 billion (up 59% on 2020-21 and down 48% on 2018-19)

- this was a 1.4% direct share of total state GVA (up 0.5% on 2020-21 and down 1.7% on 2018-19)

- total state GVA was worth $477.6 billion (up 8.4% on 2020-21 and up 12% on 2018-19)

- indirect tourism GVA was worth an extra $7.1 billion to the Victorian economy (up 57% on 2020-21 and down 45% on 2018-19)

- total tourism GVA (both direct and indirect) was worth $14.1 billion to the Victorian economy (up 58% on 2020-21 and down 47% on 2018-19).

Tourism filled jobs

In 2021–22:

- direct tourism filled jobs in Victoria totalled 121,900 jobs (up 56% on 2020-21 and down 36% on 2018-19)

- this was a 3.3% direct share of total state’s filled jobs (up 1.1% on 2020-21 and down 2.1% on 2018-19)

- total state filled jobs amounted to 3.7 million (up 3.5% on 2020-21 and up 3.1% on 2018-19)

- indirectly tourism added a further 49,200 jobs in Victoria (up 58% on 2020-21 and down 47% on 2018-19)

- total tourism filled jobs (both direct and indirect) totalled for 171,100 jobs in Victoria (up 56% on 2020-21 and down 40% on 2018-19).

Notes

What is direct contribution?

Direct contribution refers to money spent directly in the tourism industry. Without a tourism industry in Victoria, this money wouldn’t be generated, or these people wouldn’t be employed.

What is indirect contribution?

The flow-on effect of the tourism industry. In Victoria, for every dollar spent in the tourism industry, an additional 84 cents of related expenditure was generated and spent elsewhere in the economy.

Why we use GVA

GVA allows easier comparisons across industries. GVA is equal to GSP minus taxes.

Western Australia summary

Total tourism GSP

$8.7 billion

Up 28% compared with 2020–21

Down 28% compared with 2018–19

Total tourism GVA

$7.7 billion

Up 28% compared with 2020–21

Down 29% compared with 2018–19

Total tourism filled jobs

89,100

Up 23% compared with 2020–21

Down 19% compared with 2018–19

Tourism GSP

In 2021–22:

- direct tourism GSP in Western Australia was worth $4.1 billion (up 34% on 2020-21 and down 32% on 2018-19)

- this was a 1.0% direct share of total state GSP (up 0.2% on 2020-21 and down 1.1% on 2018-19)

- total state GSP was worth $404.5 billion (up 11% on 2020-21 and up 41% on 2018-19)

- indirect tourism GSP was worth an extra $4.6 billion to the Western Australian economy (up 24% on 2020-21 and down 25% on 2018-19)

- total tourism GSP (both direct and indirect) was worth $8.7 billion to the Western Australian economy (up 28% on 2020-21 and down 28% on 2018-19).

Tourism GVA

In 2021–22:

- direct tourism GVA in Western Australia was worth $3.7 billion (up 32% on 2020-21 and down 32% on 2018-19)

- this was a 1.0% direct share of total state GVA (up 0.2% on 2020-21 and down 1.0% on 2018-19)

- total state GVA was worth $390.5 billion (up 10% on 2020-21 and up 41% on 2018-19)

- indirect tourism GVA was worth an extra $3.9 billion to the Western Australian economy (up 25% on 2020-21 and down 27% on 2018-19)

- total tourism GVA (both direct and indirect) was worth $7.7 billion to the Western Australian economy (up 28% on 2020-21 and down 29% on 2018-19).

Tourism filled jobs

In 2021–22:

- direct tourism filled jobs in Western Australia totalled 61,500 jobs (up 23% on 2020-21 and down 14% on 2018-19)

- this was a 3.9% direct share of total state’s filled jobs (up 0.7% on 2020-21 and down 0.9% on 2018-19)

- total state filled jobs amounted to 1.6 million (up 5.2% on 2020-21 and up 6.6% on 2018-19)

- indirectly tourism added a further 27,500 jobs in Western Australia (up 24% on 2020-21 and down 29% on 2018-19)

- total tourism filled jobs (both direct and indirect) totalled for 89,100 in Western Australia (up 23% on 2020-21 and down 19% on 2018-19).

Notes

What is direct contribution?

Direct contribution refers to money spent directly in the tourism industry. Without a tourism industry in Western Australia, this money wouldn’t be generated, or these people wouldn’t be employed.

What is indirect contribution?

The flow-on effect of the tourism industry. In Western Australia, for every dollar spent in the tourism industry, an additional 84 cents of related additional expenditure was generated and spent elsewhere in the economy.

Why we use GVA

GVA allows easier comparisons across industries. GVA is equal to GSP minus taxes.

Data tables

Find out more about tourism consumption, jobs and economic activity in our data tables.

Changes in this issue

Changes in data sources

The Australian Bureau of Statistics (ABS) “National TSA 2021-22” released in December 2022, included a change in their metric used for reporting employment. The ABS, for the first time, reported tourism filled jobs (sourced from the Labour Account) instead of tourism employment (sourced from the Labour Force Survey). The ABS applied this change because tourism filled jobs provide a more meaningful measure of the tourism workforce. Importantly, tourism filled jobs captures the many secondary jobs that people have in the tourism sector and the highly casualised nature of work within the industry. For more details on changes please visit TSA data.

In keeping with best practice, TRA has followed the lead of the ABS, by reporting tourism filled jobs for the first time in the 2021-22 issue of the State TSA. This has seen the complete time series (2006-07 to 2021-22) revised from previous issues to report tourism filled jobs for all states and territories.

A comparison of tourism filled jobs (used in the latest State TSA 2021-22) and employed persons (used in the State TSA 2020-21 published May 2022) shows that direct tourism employment estimates between 2006-07 and 2018-19 (pre-pandemic years) have been revised upward for each state and territory and nationally in the range of 3% in 2007-08 to 10% in 2012-13.

The revisions for 2019-20 and 2020-21 were impacted by factors related to the COVID-19 pandemic. Prior to the 2021-22 National TSA release, the ABS updated the ratios they apply for estimating tourism filled jobs to account for the latest information available. Due to the rapid changes brought about by COVID, this saw significant downward adjustment to their estimates of tourism filled jobs over the pandemic period. These revisions have led to lower estimates than reported using the employed persons measure previously for the pandemic years of 2019-20 and 2020-21 (Table 5).

| Year | NSW | VIC | QLD | SA | WA | TAS | NT | ACT | Aus |

| 2006-07 | 5% | 6% | 5% | 5% | 7% | 3% | -2% | 4% | 6% |

| 2007-08 | 3% | 4% | 3% | 4% | 5% | 0% | -2% | 0% | 3% |

| 2008-09 | 5% | 7% | 4% | 5% | 7% | 2% | -4% | 6% | 5% |

| 2009-10 | 7% | 10% | 7% | 7% | 9% | 5% | 4% | 2% | 8% |

| 2010-11 | 6% | 8% | 6% | 6% | 8% | 5% | 2% | 6% | 7% |

| 2011-12 | 8% | 10% | 7% | 9% | 10% | 5% | 2% | 7% | 8% |

| 2012-13 | 10% | 11% | 8% | 11% | 12% | 8% | 7% | 8% | 10% |

| 2013-14 | 8% | 10% | 7% | 8% | 11% | 5% | 3% | 8% | 9% |

| 2014-15 | 6% | 8% | 6% | 6% | 8% | 5% | 2% | 1% | 7% |

| 2015-16 | 7% | 9% | 6% | 7% | 9% | 5% | 3% | 4% | 8% |

| 2016-17 | 5% | 7% | 4% | 6% | 6% | 3% | 1% | 2% | 6% |

| 2017-18 | 6% | 8% | 4% | 7% | 8% | 4% | 1% | 3% | 6% |

| 2018-19 | 4% | 5% | 2% | 5% | 6% | 2% | -1% | -1% | 4% |

| 2019-20 | -6% | -3% | -6% | -2% | -3% | -8% | -9% | -6% | -5% |

| 2020-21 | -18% | -29% | -16% | -7% | -11% | -19% | -20% | -25% | -19% |

Explanatory notes

Revisions to the Australian Bureau of Statistics’ (ABS) national accounts data have affected the State TSA. These data are revised annually by the ABS to reflect changes in the economy, in line with international best practice. ABS has embarked upon updating input-output relationships. This is based on the latest available supply-use tables which in this case refers to year 2019-20.

In this edition of the State TSA therefore, the input-output tables (I-O tales) used in generating indirect contribution of tourism resulting from Output and jobs multipliers, have also been revised using 2019-20 I-O tables. This has resulted in a revision of results for the whole time-series, meaning data from previous editions is not directly comparable to this STSA.

Regional expenditure data revisions also have affected this STSA. These data are sourced from the International Visitor Survey (IVS) and National Visitor Survey (NVS), year ending June 2022.

Methodology

The 2021–22 STSA publication presents a comprehensive set of data on the direct and indirect economic contribution of tourism for all states and territories. It builds on the Australian Bureau of Statistics’ (ABS) Australian Tourism Satellite Account.

The report highlights changes in 2021–22, in nominal terms. It also examines longer term patterns in tourism’s contribution to the national, state and territory economies.

ABS System of National Accounts

The Australian System of National Accounts (SNA) is based on industry classification. Industries within the SNA are characterised by their production or ‘supply’ capacity. Tourism, is a demand side concept and so has no direct industry supply characteristic distinguishable from the SNA.

The Australian TSA bridges the supply-demand gap. It:

- measures the economic contribution of tourism

- supplements the SNA.

Comparisons can then be made between:

- the tourism sector’s economic contribution, and

- conventional industries’ contribution within an economy.

Tourism sectors across different countries can also be compared.

Check the ABS’ Australian National Accounts: Tourism Satellite Account methodology for more information on the National TSA.

Sources for data and methodology

The approach in this STSA is to derive the direct contribution of tourism. It is similar to the approach developed by Pham et al. (2009). Tourism spend data and state/territory industry input-output (I-O) data are combined with the National TSA benchmark. This is to capture the:

- supply of tourism at the state/territory level

- demand for tourism at the state/territory level.

The main sources for the data and methodology are:

- unpublished modelled regional expenditure data from Tourism Research Australia’s:

- International Visitor Survey (IVS)

- National Visitor Survey (NVS).

- I-O database from The Enormous Regional Model (Horridge, Madden & Wittwer, 2003).

- National TSA produced by the ABS (2021).

- Pham, T.D., L. Dwyer and R. Spurr (2009) ‘Constructing a regional TSA: The case of Queensland’, Tourism Analysis, 13, 5/6, pp. 445-460.

- Pham, T.D. and Dwyer, L. (2013), ‘Tourism Satellite Account and Its applications in CGE Modelling’, in Tisdell (ed), The Handbook of Tourism Economics – Analysis, New Applications and Case Studies, Chapter 22, World Scientific Publishing.

- Dwyer, L. and Pham, T.D. (2012), ‘CGE Modeling’, in Dwyer, Gill and Seetaram (eds), Research Methods in Tourism, Chapter 13, Edward Elgar Publishing.

Indirect and total contribution of tourism

Indirect effects of tourism demand on businesses that provide goods and services to the tourism industry are also measured. For example, the indirect tourism demand generated from supplying a meal to a visitor. This starts with production of what the restaurant needs to make the meal. This might include fresh produce and electricity for cooking.

This approach complements the direct effects presented through the TSA framework. It provides a clearer picture of the total contribution of tourism to the economy. However, they have been calculated using I-O analysis methods. This is because the TSA framework is not designed to measure these indirect effects at state and territory level.

The I-O analysis methods provide a breakdown of the supply and demand of commodities in the Australian economy.

Multipliers for calculating tourism’s indirect effects

Multipliers for standard industries in the Australian and New Zealand Standard Industry Classification (ANZSIC) are used as the basis for calculating tourism’s indirect effects. This is because the tourism sector does not represent a single industry in the economy.